With uncertainty a key theme over the next few years, researcher Euromonitor International identifies some of the key factors that will affect the consumer market

Political instability is a key challenge going into 2017, and surprisingly, two of the biggest risks are in advanced economies – the Trump effect and Brexit.

According to Euromonitor International’s 2016 Global Consumer Trends Survey, Brexit’s impact on the global economy outside of Europe is more subdued than a Trump downturn, but it adds another element of unpredictability at a time when political volatility is a key concern.

Over the course of the year, Euromonitor International is expecting consumer expenditure to rise by 1.5% (down from 2% in 2016), with every household putting away on average $3,609 (£2,897) in savings. With the US still accounting for almost one-in-three dollars spent globally, consumer behaviour in the Trump era matters to the world.

Despite a slowing economy, Chinese consumers will continue to see one of the largest increases in spending, and expenditure in emerging and developing economies overall will grow by more than twice that of developed markets.

Authenticity, convenience and experience will continue to be trends to watch regarding the 2017 consumer, as consumers reassess their priorities and values.

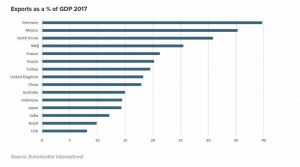

The risk of trade barriers and economic isolation is growing in western countries, as popular discontent with globalisation feeds support for populist and far-right parties. With its decision to leave the EU, the UK risks being cut out of the Single European Market, a move that would be detrimental to both the UK and EU economies.

The World Trade Organisation (WTO) estimates that 2016 saw the slowest growth in trade since the financial crisis. In 2017, Euromonitor International expects trade growth to strengthen somewhat on the back of stronger economic growth, but with increasing downside risks from anti-globalisation sentiment.

In Europe, right-wing parties are gaining ground, adding to significant political uncertainty for many. Continued concern surrounding Brexit is estimated to lower UK demand and add to vulnerability of European economies in 2017.

Global production output is expected to accelerate in 2017, reaching 5% annual growth. Growing eco-awareness is leading consumers to pressure companies for stronger green credentials. On the supply side, fast depletion of resources triggered by population and economic growth, as well as fears over security of supplies, mean that key inputs are under stress. The impact on the bottom line through supply chain disruptions or reputational damage can be extremely high.

In 2017, we expect to see more companies taking a proactive stance on resource management and sustainable sourcing. The whole supply chain is increasingly coming under the spotlight. It is no longer enough for the core business to be sustainable; suppliers and partners also need strong credentials and consumers require support to manage the end-of-life of their products. The imperative to change patterns of production and consumption will only grow, and those that are ahead of the curve by educating and leading consumers will benefit.

The Circular Economy will gain traction as a viable alternative business model; it is the antithesis of the current “build, buy, bury” model, consisting of a system in which everything is reused and nothing is wasted.

The cost-saving options in the Circular Economy form a key pull factor for businesses. There are also reputational benefits, as consumers increasingly base their purchasing decisions on brands’ green credentials. The Circular Economy closely resonates with consumers changing from conspicuous consumption to conscious consumption. We expect more and more multinationals to embrace the Circular Economy in 2017.

In 2017, there will be 101 million households with over $100,000 in annual income. Out of those, 74% will be in 1,150 cities

Technological advances, including the arrival of smartphones to the masses, are forever altering the way consumers browse and buy all types of products and services. As the global populace becomes more digitally connected, new technology is opening the doors to brands being able to better target their end-consumer and offer new ways of conducting commerce.

Consumers turn to digital channels for purchases like travel, which can be easily researched and purchased at lower prices online. Such service-oriented purchases are helping to propel digital commerce growth and will continue to do so in 2017.

This year, the number of households globally will reach 2.1 billion, driven by growth in emerging markets. The year ahead will continue to be shaped by long-term demographic shifts.

Products likely to be in demand, particularly in developed markets, include multipurpose products that can bake, roast, sear, stew and dispense drinks and multi-blenders that chop, puree, liquefy and crush ice. In addition, smart TVs with streaming, gaming, app, payment and screen-sharing capabilities are gaining popularity, as well as kitchen draws with storage and cooling capabilities.

In emerging and developing markets, real consumer spending growth is expected to strengthen in 2017 to 3.8% (from 3.3% in 2016), but the overall trend is for continuing weak growth following six consecutive years of deceleration. Emerging Asia, with markets such as China, India and the ASEAN countries**, will be the main drivers of growth, but elsewhere prospects will be uneven due to widely diverging recoveries and persistently low commodity prices. Against this background, commercial opportunities will be hard to come by, and the competitive landscape will intensify further in 2017.

As income inequality is expected to worsen in 2017, across 66 out of the 85 major economies that Euromonitor International tracks, companies need to strategise for the increasing polarisation of consumer markets. However, it is vital not to overlook the middle class, so as to retain this important consumer base.

Instead of racing to the bottom and eroding brand value, businesses will need to innovate to offer good quality at a good price as a smarter strategy in order to retain the loyalty of the squeezed middle and revive their demand

While enticing the “squeezed middle” with big discounts was top of the agenda in the aftermath of the global financial crisis, businesses have come to realise that price promotions are not the only way. Instead of racing to the bottom and eroding brand value, businesses will need to innovate to offer good quality at a good price as a smarter strategy in order to retain the loyalty of the squeezed middle and revive their demand.

Opportunities brought by urbanisation are substantial, especially since urban households tend to have higher purchasing power. The transition to smaller-sized households in cities compared to rural areas will further give rise to new consumption trends and boost demand for goods and services. Urbanisation can also spur economic growth, as cities draw in diverse businesses, which in turn generate investment and economic activity.

The median age of the global population has been rising steadily and will hit 30.1 years for the first time in 2017 (up from 27.9 years a decade earlier). Western Europe will continue to lead global ageing, as the trends of delaying marriage and childbirth, higher female labour participation and improvements in life expectancy are the most prominent in this region. The median age of the population in western Europe is set to reach 41.1 years. Globally, the 65+ age group will be the fastest-growing.

Population ageing hugely impacts consumer goods industries, presenting them with a range of opportunities to provide senior consumers with goods and services to meet their changing lifestyles, shopping and spending habits, widely varying income and wealth levels, expectations and needs.

So uncertainty is the main theme for 2017. In advanced economies, the key risk is political volatility stemming from the Trump presidency and Brexit and the euro zone will continue to see poor growth, with all major economies seeing growth slow down next year.

On the other hand, growth in emerging and developing markets is expected to strengthen and both Brazil and Russia will return to growth next year. India should continue to perform well, with the strongest growth in all major markets.

**The ASEAN countries are: Brunei, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand and Viet Nam.