The bedroom furniture market has been severely impacted by Covid-19, according to the latest report from AMA Research.

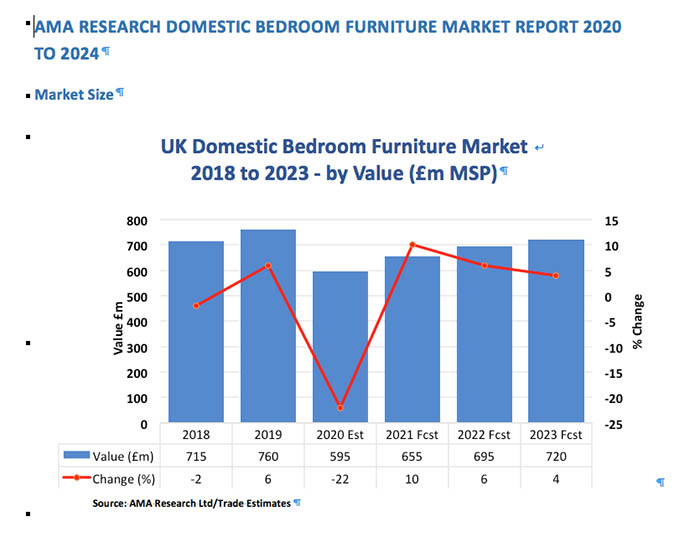

The Domestic Bedroom Furniture Market Report – UK 2020-2024 forecast that bedroom furniture sales will fall to £595 million in 2020, down by nearly a quarter (22%) from £760m in 2019.

The report blamed the fact that the Covid-19 pandemic, which has changed consumer buying habits with homeowners prioritising the conversion of spare rooms into home offices rather than spare or guest bedrooms.

Good news for those retailers who have moved into selling home offices and studies but bad news for bedroom furniture sales.

The bedroom furniture market had been on an upward trend, with sales up 6% in 2019 (£760m) from £715m in 2018. There were also increases in sales of freestanding and fitted bedroom furniture, which accounted for 27% of the market by value. Modular furniture also showed an increase in popularity, according to the report – a trend likely to be sustained by the trend towards smaller houses.

Report author and AMA senior market research analyst Jane Tarver said: “The bedroom furniture market is forecast to show a significant fall in 2020, followed by steady growth in the next few years, reflecting the lower economic performance forecasts, as a result of the measures to combat the pandemic and the current levels of uncertainty in the minds of businesses and consumers alike. “This is likely to impact on the market for high value home improvement purchases and on the new house-building market, where fitted bedroom furniture can often be installed by the builders.”

Report author and AMA senior market research analyst Jane Tarver said: “The bedroom furniture market is forecast to show a significant fall in 2020, followed by steady growth in the next few years, reflecting the lower economic performance forecasts, as a result of the measures to combat the pandemic and the current levels of uncertainty in the minds of businesses and consumers alike. “This is likely to impact on the market for high value home improvement purchases and on the new house-building market, where fitted bedroom furniture can often be installed by the builders.”

The report concluded that prospects for the next four years remained uncertain, “with the end of the pandemic still not in sight and the outcome of the ongoing Brexit negotiations yet to be determined”.

It added: “However, the bedroom furniture market is forecast to show solid growth in the next few years, albeit at a slower rate than the overall furniture industry.”

The report forecast that post-Covid, sales over the next few years would regain their upward trajectory. The AMA graph shows that forecasts suggest sales would rise by 10% to around £655m in 2021, £695m in 2022, reaching £720m in 2023.

Breaking the sales down by channel, the report showed that 28% of bedroom furniture sales was through retail specialists, 21% through furniture multiples, 18% online and by mail order, 12% through department stores, 7% through furniture independents and only 6% through DIY multiples.