The UK independent kitchen market was worth £1.76 billion and holds a 35.5% share of the nearly £5 billion new kitchen spend in 2021, says researchers JKMR.

JKMR has valued the fitted kitchen products market at £4.97 billion. Independents account for 35.5% of the total market share, with trade retailers (Howdens and the merchants) in second with 28.5%. Consumer multiples like Wren, B&Q and Homebase make up 19% of the market, with direct contracts only at 9%. Online retail is only 8% of the total market share.

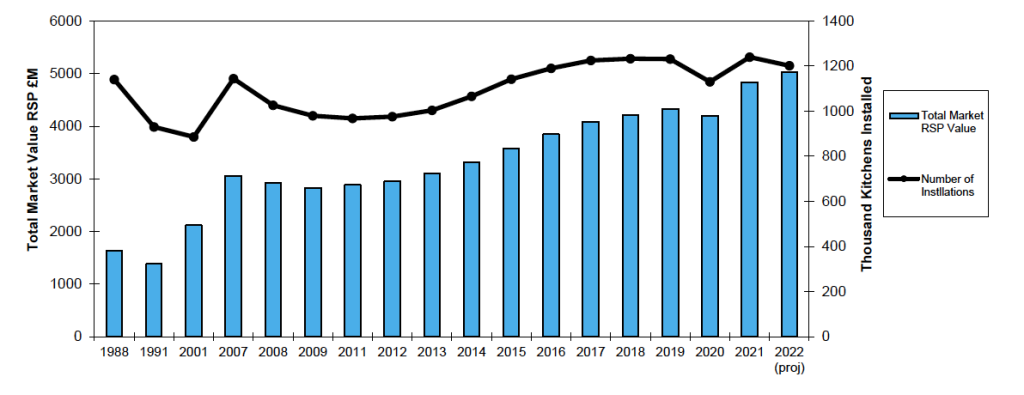

The total market value had steady growth since it dipped in 2009. However, there was a drop in 2020 because of the full lockdowns. As a result, the total market value has jumped after the 2020 slump and is projected to grow in 2022.

There were 1.25 million new kitchens purchased in 2021. The number of installations also rose in 2021 after a slight drop in 2020. However, unlike the overall market value, the number of installations is predicted to drop in 2022.

JKMR said in the summary of Market Trends: UK Kitchen Market Size: “The loss of much Q2 2020 retail business allied to building sites mothballed for part of the year meant market volume and value decline for 2020, but a markedly strong ‘bounce back’ for most retail operations in Q3/4, plus increases in project budgets mitigated the value decline.

“Despite the Q1 2021 lockdown, consumer desire for home refurbishment, plus a degree of ‘catch-up’ of new-build activity, enabled notable market growth in 2021, allowing installations to just exceed 2018 levels and market value to rise 15%. At this stage, it is projected that wider economic stress will see 2022 installations down on 2021, but price rises, if nothing else, will ensure further value growth.”

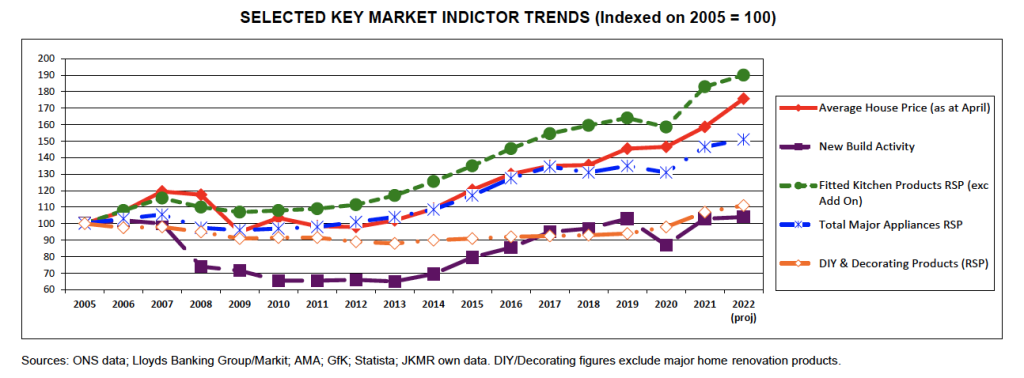

JKMR’s research into the key market factor indicators – which includes average house price, new-build activity, fitted kitchen products RSP, total major appliances RSP, and DIY and decorating products RSP – found that all areas were up in 2021 compared with 2020 and subsequent years. In addition, projected growth for all areas for 2022 is steadily rising, although not to the extent of the considerable jump from 2020 to 2021.

JKMR said about the key market indicators: “The 2021 market value continued upward due to more market activity and price rises. Unlike the broader DIY market, the fitted kitchen products market is biased toward higher-earning owner-occupiers with more home equity, and thus its growth rates tend to show a nearer correlation to house price movements.

“Both it and the total MDA market saw a small dip in 2020 market value, with much of Q2 trading wiped out for physical store retailers; but price increases and the still buoyant property market drove notable growth for both sectors in 2021, which are expected to continue in 2022.”

- To read more about the fitted kitchen market visit the JKMR website