Diane Wehrle, the marketing and insights director at retail analyst Springboard, considers the wider implications of the global pandemic for bricks-and-mortar retail.

I have been musing on the wider implications of the global coronavirus pandemic for physical retail. There are two key questions I am often asked. Firstly, can the pandemic be seen as the start of the end for bricks-and-mortar retail? And secondly, when should we expect footfall levels to return or even surpass pre-pandemic levels?

My aim here is to present my views, but supported by real data rather than hearsay and supposition. At Springboard, we have a rich and broad data lake that is so important in a landscape that can shift even overnight.

So, is it the start of the end for bricks-and-mortar retail?

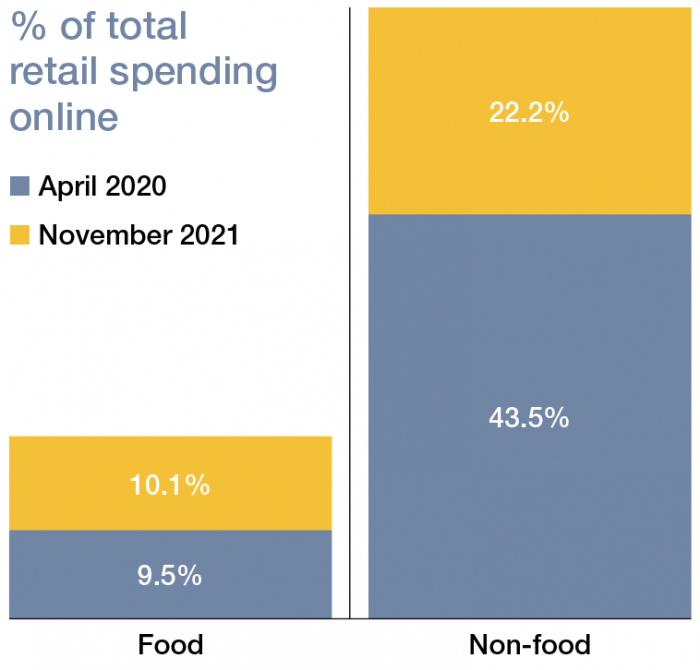

Since the Covid pandemic started in March 2020, the retail industry has undergone the greatest shock for decades, with many stores having had to close for extended periods. However, the pandemic certainly does not mean the end of bricks-and-mortar retail, and if anything demonstrates the importance of physical stores to consumers. In the depths of the mandated lockdown in the UK during 2020, when the only stores trading were those classed as essential, online spending on non-food in the UK doubled, but peaked at 43% of total non-food retail spend, with 56% remaining in store.

In large part, the increased migration of retail spending online has been an exacerbation of behaviour that was clearly evident even before Covid. The key aspect to remember is that, despite the increased amount of retail spending online, the majority of retail spending continues to remain in-store. Indeed, since the reopening of all stores and the resumption of normal trading conditions, this has since reduced significantly and in the UK the percentage of non-food spending that is online has reduced by half to 22% of total non-food spending, with 78% remaining in physical stores.

The fact that even a global pandemic has not significantly dented the extent to which consumers shop in stores demonstrates the continuing importance of in-store retailing, and reinforces its long-term future. Indeed, while shopper traffic in high streets and out-of-town locations is lower than before the pandemic, it has strengthened noticeably – from 83% below 2019 in April 2020 to 16% in November 2021 in the UK.

The importance of bricks-and-mortar retailing to shoppers is reinforced by the fact that more than half of those consumers who are now working from home have not changed their shopping habits from before Covid (Springboard US and UK Retail Consumer Surveys), which demonstrates why a number of pure online retailers are currently investing in bricks-and-mortar stores that will trade alongside their digital offering.

Where the challenge for bricks-and-mortar lies, however, is in successfully integrating physical with digital. The two formats need to offer consumers a fully integrated shopping experience with stores offering the sensory and in-person experience that is lacking online, while their online offer has the full product range, smooths out any supply difficulties and delivers time and cost efficiencies.

So when should we expect footfall figures to return or even surpass pre-pandemic levels?

The impact of Covid is likely to be felt for an extended period of time, and it has speeded up the transition of some spend online that was already occurring before Covid. Indeed, over the past decade in the UK high street/out-of-town, foot traffic has declined every year by an average of 2%. While a proportion of online spend has returned to physical stores since they reopened after the first wave of Covid, moving forward there will inevitably remain a greater proportion of spending that

is online.

Part of this is down to the fact that working from home is becoming a key characteristic of office working, resulting in far fewer employees travelling to high streets. and this dampens daytime foot traffic and so reduces the available spend for physical stores.

Footfall will return to pre-pandemic levels, and is likely to settle at between 5% and 10% below the 2019 level for at least the next year. However, the reduction of online spending that has occurred since the reopening of physical stores has demonstrated that there is a desire for person-to-person interaction and sensory stimulus that sit at the heart of in-store shopping.

It is these aspects of the shopping experience that will ensure the longevity of stores and ensure that bricks-and-mortar retailing will outlast this global pandemic.