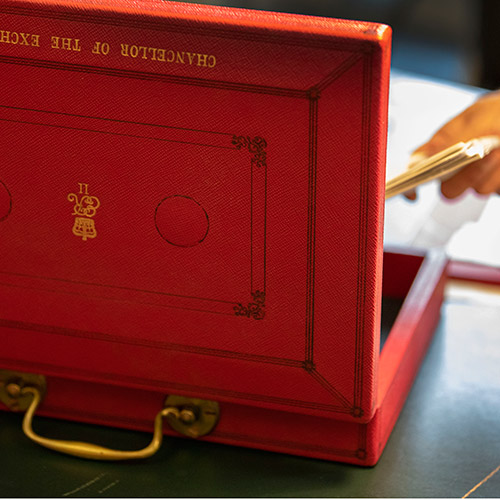

Chancellor Rishi Sunak’s first Budget has been described as a mixed bag with small businesses welcoming a number of announcements and larger businesses ruing decisions made.

The coronavirus-dominated Budget, delivered on Wednesday, suspended business rates for small business, which was seen as a huge bonus for town centres and high streets across the UK.

The Bathroom Manufacturers Association has welcomed stimulus measures set out in the Budget.

BMA chief executive Tom Reynolds said the “headline-grabbing £30 billion package” to help the economy cope with COVID-19 and a large stimulus package will give consumers confidence and a lift for bathroom manufacturers after the temporary economic shock of coronavirus.

Reynolds said: “The Budget included specific measures that will help BMA members including an increase in R&D tax credits from 12% to 15%.

“There was a sense of optimism in our sector early in the year, which does seem to have taken a dent due to coronavirus. The Chancellor’s package of emergency measures will be helpful to SMEs to weather the storm.”

The Kitchen Bathroom Bedroom Specialists Association (KBSA) also welcomed the Chancellor’s “splash-the-cash” Budget and its pledges to support business development and economic growth.

Said KBSA national account manager Allister Reed: “The introduction of a 100% business rates retail discount for one year for retail businesses with a rateable value below £51,000 is welcome. There were also other measures, such as refunds for businesses and employers required to access Statutory Sick Pay (SSP), an additional £2.2bn funding support for those small businesses that pay little or no business rates because of Small Business Rate Relief (SBBR), and a new temporary Coronavirus Business Interruption Loan Scheme.

“The recent falls in stock market values and the drop in base rates from 0.25% from 0.75% by the Bank of England are signs that the economy is fragile and that the impact of COVID-19, could be far-reaching.

“The Government is hoping that the temporary measures announced in the Budget will reduce the negative impact on the economy and that other substantial investments announced, particularly on new housing and infrastructure, will help to rebuild confidence.”

Mike Cherry, national chairman of the Federation of Small Businesses (FSB), said the Chancellor, thankfully, unveiled a “small-business” Budget.

Cherry said: “The measures he’s put forward – coupled with those unveiled by the Bank of England this week – should go a long way to reinjecting optimism back into the small-business community after years of uncertainty.

“Expanding access to statutory sick pay for those impacted by coronavirus is the right thing to do, and so too is making that access affordable for small businesses. By announcing an extension of the retail discount and an SSP rebate for small firms, the Chancellor has shown he’s on their side. The rebate must be easy to access.”

The British Retail Consortium (BRC) said that while consumers in the UK benefit from a diversity of retailers, both big and small, in our local communities, the Budget did little for larger retailers – offering a string of cost increases with no respite in the short term.

Helen Dickinson, chief executive of the BRC, said: “Despite announcing his support for British business, the Chancellor has failed to provide any relief for larger retailers, who employ the majority of the industry’s three million workers and currently foot most of the industry’s £7.5 billion business rates bill. In April, these retailers will face yet another rise in business rates across England, piling on even more pressure on shops at a time when they are squeezed by lower demand and increasing costs arising from coronavirus.”

The Builders Merchants Federation (BMF) said there is general concern around coronavirus and a potential downturn in the home-improvement market, where projects are cancelled or postponed, because either the homeowner is confined at home, unable to work, or that their trade customers are unavailable if they have to self-isolate.

John Newcomb, chief executive of the BMF, said he was disappointed not to hear more from the Chancellor about investing in new buildings and existing properties to decarbonise homes on the road to a net zero carbon economy. He also pointed out that household energy-efficiency was noticeable by its absence.

“Promises to introduce schemes for heat pumps and renewable heating in 2022, however welcome, are too vague and insufficient for the task we all face,” Newcomb said. “A package of incentives – including a cut in VAT to 5% for home improvements – was what the industry had called for to persuade and encourage residents to upgrade their home.”

The Budget at a glance

Coronavirus loans

The Government will support businesses that experience increased costs or disruptions to their cash flow. This includes a Coronavirus Business Interruption Loan Scheme – a £2.2 billion grant scheme for small businesses, and a dedicated helpline for those who need a deferral period on their tax liabilities.

Business rates relief

To support small businesses affected by COVID-19, the Government is increasing business rates relief further to 100% for 2020/21.

Sick pay

The Government will support small and medium-sized businesses and employers to cope with the extra costs of paying COVID-19-related Statutory Sick Pay (SSP) by refunding eligible SSP costs. Employers with fewer than 250 employees will be eligible to reclaim spending for any employee who has claimed SSP as a result of coronavirus for up to 14 days. As well as this, workers who fall ill or have been advised to self-isolate, will be eligible for SSP from day one, rather than day four.

Wage increases

The Government has announced a new, ambitious target for the National Living Wage (NLW) to reach two-thirds of median earnings and be extended to workers aged 21 and over by 2024. The NLW was already increasing from £8.21 to £8.72 next month, but in the Budget, the Chancellor announced plans to increase it to over £10.50 by 2024 for workers over the age of 21.

The Budget at a glance

Coronavirus loans

The Government will support businesses that experience increased costs or disruptions to their cash flow. This includes a Coronavirus Business Interruption Loan Scheme – a £2.2 billion grant scheme for small businesses, and a dedicated helpline for those who need a deferral period on their tax liabilities.

Business rates relief

To support small businesses affected by COVID-19, the Government is increasing business rates relief further to 100% for 2020/21.

Sick pay

The Government will support small and medium-sized businesses and employers to cope with the extra costs of paying COVID-19-related Statutory Sick Pay (SSP) by refunding eligible SSP costs. Employers with fewer than 250 employees will be eligible to reclaim spending for any employee who has claimed SSP as a result of coronavirus for up to 14 days. As well as this, workers who fall ill or have been advised to self-isolate, will be eligible for SSP from day one, rather than day four.

Wage increases

The Government has announced a new, ambitious target for the National Living Wage (NLW) to reach two-thirds of median earnings and be extended to workers aged 21 and over by 2024. The NLW was already increasing from £8.21 to £8.72 next month, but in the Budget, the Chancellor announced plans to increase it to over £10.50 by 2024 for workers over the age of 21.